Profit may not be the core ethos of every business, but no business can thrive without it. Effective financial management is essential, especially in the fast-paced world of supply chains.

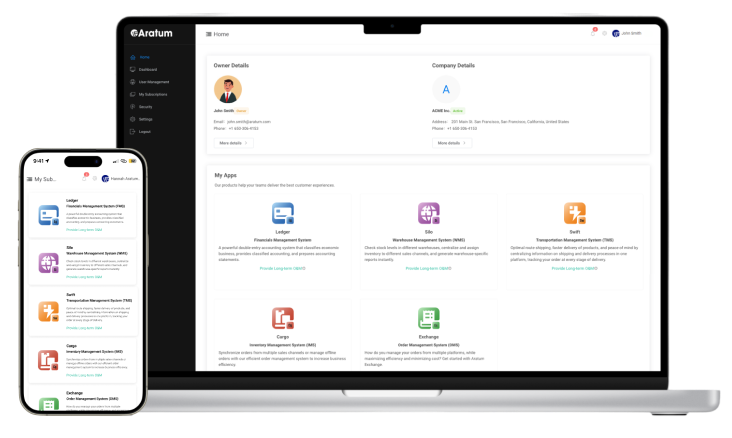

Aratum’s cloud-based, AI-driven financial management system empowers businesses to become more efficient, agile, resilient, and cost-effective, meeting every customer and market demand head-on.

Automated Financial Reporting

Real-time Financial Data Visibility

Predictive Financial Modeling Tools

Digital Billing and Invoicing

Seamless Workflow Management with API Integration

Financial Consolidation

Cloud/Multi-cloud/Hybrid Solutions

Security with Identity Access Management (IAM)

Aratum's automated financial reporting feature streamlines the preparation of financial statements and reports, reducing the time and effort required for manual data entry and reconciliation. The system automatically pulls data from various sources, ensuring accuracy and consistency across reports.

The system offers real-time visibility into financial data, empowering organizations to make informed decisions quickly. By providing instant access to up-to-date financial information, Aratum helps businesses monitor cash flow, track expenses, and analyze financial trends without delay.

Aratum's predictive financial modeling tools utilize advanced algorithms and machine learning to forecast future financial performance, identify potential risks, and uncover growth opportunities. By anticipating trends and challenges, businesses can better prepare for the future and stay competitive.

The digital billing and invoicing feature simplifies billing by automating invoice generation, distribution, and tracking. This reduces manual errors, accelerates payment cycles, and improves cash flow management. By digitizing billing operations, businesses can enhance customer satisfaction through faster, more accurate invoicing and convenient payment options.

Aratum's financial management system supports seamless workflow through API integration, enabling smooth connectivity with existing business applications and systems. It enhances operational efficiency by facilitating end-to-end financial processes and driving department collaboration.

The financial consolidation feature allows organizations to aggregate financial data from multiple entities, departments, or subsidiaries into a unified view. This capability simplifies the consolidation process, ensures compliance with accounting standards, and provides a comprehensive picture of the company's financial health.

Aratum's financial management system offers flexible deployment options, including cloud, multi-cloud, and hybrid solutions. This allows businesses to choose the best environment for their operational needs and strategic goals. This flexibility enables seamless scalability, reducing infrastructure costs and enhancing system performance.

The system incorporates robust security measures through Identity Access Management (IAM), providing granular control over user access and permissions. This ensures that only authorized personnel can access sensitive financial data, minimizing the risk of unauthorized access or data breaches.

Optimizes resource allocation, streamlines procurement, and ensures compliance with regulations, supporting both patient care and financial sustainability.

Encompasses rigorous budgeting for research and development, efficient procurement of raw materials and packaging, and compliance with stringent regulatory requirements for innovation, superb product quality, and sustainable growth.

Optimizes capital allocation and liquidity and mitigates financial risks. It also facilitates smooth transactions and fosters stakeholder trust, ultimately contributing to overall business resilience and long-term success.

Involves budgeting for inventory procurement, optimizing pricing strategies, and managing cash flow to ensure efficient operations, timely product delivery, and profitability, enhance customer satisfaction, and drive business growth.

Optimizes payment processing, securely manages transactional data, monitors revenue streams to ensure profitability, drives trust with customers and suppliers, and supports scalable growth in the digital marketplace.

Focuses on investments in temperature-controlled storage, transportation infrastructure, and monitoring technologies to ensure product integrity, minimize spoilage, comply with regulatory standards, safeguard public health, and maintain operational efficiency.

Optimizes freight costs, manages fuel expenses, and invests in fleet maintenance to ensure timely and cost-effective delivery of goods. This enhances customer satisfaction and profitability while maintaining operational efficiency.

Drives efficient resource allocation for raw materials procurement, production processes, and equipment maintenance. It also optimizes operational costs and inventory levels to meet demand while maximizing profitability and ensuring product quality and regulatory compliance.

Allocates resources for robust data protection measures, invests in advanced threat detection technologies, and implements risk mitigation strategies to safeguard sensitive information, protect against cyber threats, and maintain stakeholder trust.

Enhances specialized storage, safety protocols, and regulatory compliance to mitigate risks with hazardous materials, safeguard employees, protect the environment, and reduce liabilities.

Appropriately allocates budget for procurement, transparent expenditure tracking, and compliance with fiscal regulations to ensure accountability, efficient service delivery, and responsible use of taxpayer funds, improving public trust and supporting effective governance.

Optimizes infrastructure investments, controls operational costs, and promotes sustainable resource management to ensure reliable service delivery, mitigate environmental impact, and support long-term economic viability.

A multinational FMCG company in Greece known for its diverse portfolio of food and beverage products faced operational challenges due to fluctuating raw material costs, inefficient inventory management, and escalating distribution expenses that impacted its profitability. It hindered its ability to meet consumer demand effectively.

Because of these challenges, the FMCS company sought our financial management system to streamline its operations.

Financial management in supply chains involves the strategic planning, monitoring, and controlling of financial resources and activities across the entire supply chain, from procurement to distribution, to optimize costs, mitigate risks, and enhance financial performance.

Effective financial management positively impacts supply chain performance by optimizing resource utilization, reducing costs, enhancing cash flow management, improving inventory turnover, mitigating financial risks, and ensuring compliance with regulatory requirements.

Organizations can improve their financial management system by implementing robust budgeting and forecasting processes, leveraging technology for data analytics and automation, enhancing collaboration with suppliers and partners, adopting best practices for risk management, and investing in employee training and development. All these can be implemented through Aratum’s infrastructure.

Aratum’s financial consolidation feature unifies data from multiple entities or units, simplifying processes, reducing errors, and ensuring compliance with accounting standards, allowing faster decision-making.

Aratum’s financial management, integrated with other supply chain functions such as procurement, logistics, and operations, enables seamless data sharing, improved visibility, better decision-making, enhanced collaboration, and greater efficiency across the entire supply chain ecosystem.

Aratum’s financial management system is designed to benefit businesses of all sizes and industries, including healthcare, manufacturing, retail, logistics, and financial services. Its customizable features allow it to fit the unique needs of different organizations.

Organizations can measure effectiveness through key performance indicators (KPIs) such as cost-to-serve, cash-to-cash cycle time, inventory turnover, working capital ratio, return on investment (ROI), and compliance with financial benchmarks and targets. Regular performance reviews and audits can also provide insights into areas for improvement.

Organizations can mitigate financial risks in their supply chains by diversifying their supplier base, conducting thorough financial health assessments, establishing contingency plans, hedging against currency fluctuations, implementing robust contract management processes, and investing in insurance policies to cover potential losses.

The implementation time for Aratum’s financial management system varies depending on the size of the warehouse, the complexity of the operations, and the level of customization required. A typical implementation can take anywhere from a few weeks to several months.

To implement a financial management system in your supply chain, you can rely on Aratum solutions tailored to your business requirements to help you get started and gain visibility, efficiency, and resiliency.

Aratum is a globally recognized software provider specializing in developing supply chain management solutions. Our software solutions incorporate advanced algorithms and optimized data structures to facilitate efficient data processing and information dissemination across organizations.

Leveraging cutting-edge technologies such as machine learning and artificial intelligence, the software enables automated decision-making and real-time analytics, enhancing supply chain visibility and improving overall performance.

With a focus on delivering robust and scalable solutions, Aratum is committed to providing our clients with the tools necessary to optimize their supply chain operations and gain a competitive edge in your respective markets.

© 2024 Aratum or an Aratum affiliate company. All rights reserved. No part of this publication may be reproduced or transmitted in any form or for any purpose without the express permission of Aratum or an Aratum affiliate company. The information contained herein may be changed without prior notice. Some software products marketed by Aratum and its distributors contain proprietary software components of other software vendors. National product specifications may vary. These materials are provided by Aratum or an Aratum affiliate company for informational purposes only, without representation or warranty of any kind, and Aratum or its affiliated companies shall not be liable for errors or omissions with respect to the materials. The only warranties for Aratum or Aratum affiliate company products and services are those that are set forth in the express warranty statements accompanying such products and services, if any. Nothing herein should be construed as constituting an additional warranty. In particular, Aratum or its affiliated companies have no obligation to pursue any course of business outlined in this document or any related presentation, or to develop or release any functionality mentioned therein. This document, or any related presentation, and Aratum’s or its affiliated companies’ strategy and possible future developments, products, and/or platforms, directions, and functionality are all subject to change and may be changed by Aratum or its affiliated companies at any time for any reason without notice. The information in this document is not a commitment, promise, or legal obligation to deliver any material, code, or functionality. All forward-looking statements are subject to various risks and uncertainties that could cause actual results to differ materially from expectations. Readers are cautioned not to place undue reliance on these forward-looking statements, and they should not be relied upon in making purchasing decisions. Aratum and other Aratum products and services mentioned herein as well as their respective logos are trademarks or registered trademarks of Aratum (or an Aratum affiliate company) globally. All other product and service names mentioned are the trademarks of their respective companies. See aratum.com for additional trademark information and notices.