Welcome to the dynamic world of international trade, where the wheels of eCommerce utilize a language of their own: Incoterms. As we enter 2024, merchants must stay ahead of the curve and confidently navigate the numerous pathways of global transactions.

Imagine a company based in the United States that manufactures electronic gadgets. They have recently secured a deal with a distributor in Germany to export their products. As part of the negotiation process, both parties must agree on the terms of the sale, including the responsibilities and liabilities for the goods during transit. This is where Incoterms in 2024 come into play.

The company and the German distributor use the “FOB (Free On Board) – Port of Origin” Incoterm for their transaction. Under this Incoterm, the seller (the US company) is responsible for delivering the goods to the agreed-upon port of shipment (for example, a port in Los Angeles). Once the goods are loaded onto the vessel, ownership and risk are transferred to the buyer (the German distributor). From that point onwards, the buyer bears the risk and cost of transporting the goods to Germany, including any insurance, customs duties, and import taxes.

In this article, we dive into the updates and nuances of Incoterms 2024, indispensable trade terms that shape the landscape of cross-border commerce. Whether you’re a seasoned importer or exporter or just setting sail into global trade, discover how these international trade benchmarks can be the key to smoother, more efficient business transactions.

What are Incoterms?

Simply put, the International Commercial Terms (Incoterms) are the conditions of sale agreed upon by both the seller and the buyer of products when doing business internationally. All governments and legal agencies worldwide recognize these regulations. Incoterms in 2024 explicitly outlines the responsibilities, expenses, and risks that fall under the purview of both buyer and seller.

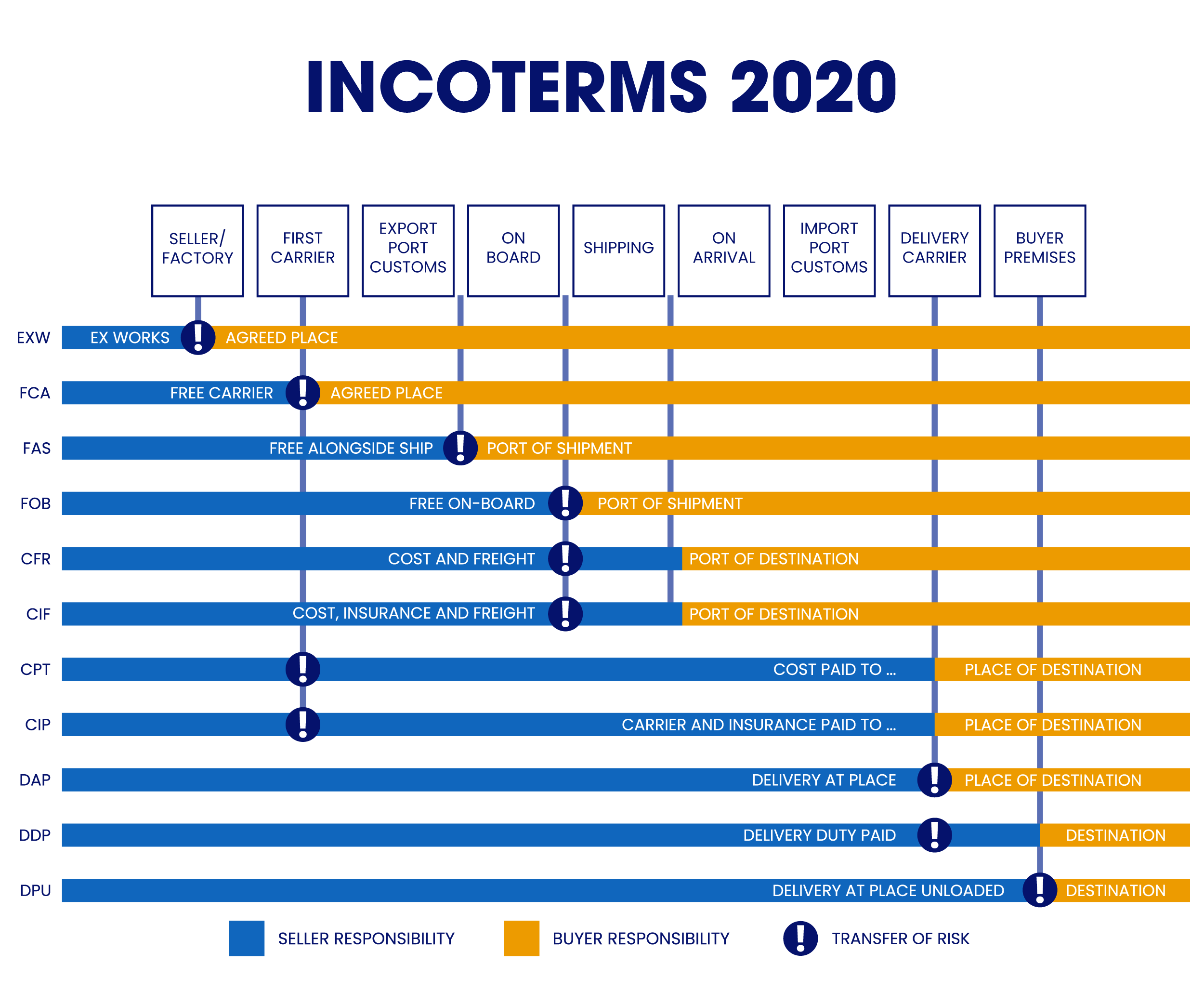

Success in the ever-evolving realm of international eCommerce is often determined by compliance. When the seller’s expenses and risks are passed on to the buyer, this is specified in the Incoterm. It’s important to understand that not every situation requires the application of every rule. Some cover any kind of transportation. Transportation via all means (air, sea, land, and train) includes FCA, CPT, CIP, DAP, DPU, and DDP. FAS, FOB, and CFR. CIF is also included in sea/inland waterway shipping (sea). We’ll tackle every Incoterm in depth in a later section below.

Incoterms are updated by the International Chamber of Commerce (ICC) about every 10 years. Interestingly, no particular Incoterms for 2023 or 2024 exist. The Incoterms 2020 applies to shipments that are currently taking place. Expect the next major Incoterms update in 2030.

INCOTERMS 2024 – Guide for International Sellers & Buyers (supremecomponents.com)

An efficient supply chain can be rendered useless if you ignore the proper usage of Incoterms. In 2024. Learning these conditions is the foundation for a successful global eCommerce presence.

Incoterms 2024 – Its Importance

In negotiations, language is crucial, but when parties speak different languages, things may become confusing. Incoterms clarify the nature of the transaction and keep all parties informed. For various forms of transportation, different Incoterms in 2024 would be used.

You must be precise when working on a contract involving international shipping. Incoterms specify who is accountable for how much each transaction will cost and what risks there are. These terminologies aid in maintaining mutual understanding and guarantee the effective and secure delivery of the items.

Incoterms 2024 Challenges

The biggest advantage of employing Incoterms in 2024 is the standardization and specificity of intricate international commerce concerns. Trading has been considerably more accessible with a framework that removes uncertainty between countries, particularly when negotiating conditions. It prevents you from wasting time and money on legal counsel, who must create wording that translates Incoterms 2024 into other languages.

One potential drawback of Incoterms in 2024 is that buyers and sellers frequently have differing preferences for specific terms. For example, sellers may choose CIF if they understand their shipments better than purchasers. On the other hand, buyers could favor FOB for the same reasons. It becomes more of a discussion about which terminology to employ than the terms’ clarity. The concepts are not the problem, but problems arise when coming to terms with another party.

Understanding the 11 Incoterms and How They Work

There are a total of 11 Incoterms that are divided into four main categories. The initial letter of an incoterm is used to identify its category.

- E-Term: The buyer makes all transportation-related arrangements.

- F-terms: The buyer makes most of the transport-related arrangements. The shipping and customs arrangements are the seller’s responsibility.

- C-terms: C-terms function in reverse. The vendor makes the majority of shipping-related arrangements. The customer bears the risk of the shipment.

- D-terms: Under these, the seller is given responsibility. The vendor assumes the risks and expenses.

Since the Incoterms 2020 is the latest version, we will utilize it. These revised terms offer greater precision and clarity, in line with contemporary trade standards. It helps to minimize miscommunications and legal conflicts in global commerce.

Do note that it is not illegal if the buyer and seller agree to use the 2010 Incoterms. To prevent misunderstandings or disagreements, it is crucial that the sales contract expressly states which set of Incoterms in 2024 is being used.

Incoterm Rules for Any Mode of Transport

EXW (Ex Works)

The buyer can collect the products from the seller’s location or another designated site. The seller’s responsibilities exclude customs clearance and truck loading. After loading, all risks and expenses are the buyer’s responsibility. Unless specified otherwise, the seller isn’t liable for loading the buyer’s vehicle. The buyer must handle export documentation for customs.

FCA (Free Carrier)

The FCA delivery clause covers all transport modes. The seller handles customs clearance and transports goods to the agreed terminal. If loading is at the seller’s address, they pack items into the truck. The seller packs but isn’t obligated to unload at a transport company terminal.

DPU (Delivered at Place Unloaded)

DPU holds the seller responsible until delivery. The seller unloads items for a buyer. The seller covers customs expenses for export and transport. Buyer handles import customs.

DAP (Delivered at Place):

The seller handles shipping to a specified location, and the buyer assumes risk upon delivery. The buyer covers import customs charges, and the seller clears items for export.

CPT (Carriage Paid To)

With CPT, the seller handles shipping expenses to the delivery location. Buyer assumes risks upon delivery to the first carrier. The seller covers export customs expenses, and the buyer arranges import customs. Buyers coordinate with sellers regarding THC inclusion in transportation prices collected by vendors from the terminal.

CIP (Carriage and Insurance Paid To)

The seller pays for all the transport and insurance of a product to a specified destination. Once the products are delivered, the risk transfers to the first carrier. A seller’s delivery commitment is fulfilled once the items are turned over to the carrier. They are not liable when the items arrive at their final destination.

DDP (Delivered, Duty Paid): The seller organizes the entire shipping process until the products are delivered to a specified location. After delivery, the customer assumes the risk. While import customs charges, fees, and taxes are the buyer’s responsibility, the seller is in charge of clearing items for export.

Incoterm Rules for Maritime Transport

FAS (Free Alongside Ship)

The seller collects items from the factory, arranges export clearance and delivers to the departure point (usually ship loading dock). The buyer takes over the delivery process from there, including the initial leg of travel.

FOB (Free On Board)

The seller bears expenses and risks until the ship’s arrival. Fees and liabilities are split between buyer and seller upon boarding. Buyer assumes all responsibilities upon unloading. The seller covers export customs and transportation expenses, and the buyer arranges import customs.

CFR (Cost and Freight)

The customer is not responsible for the delivery expenses until the products are put on the ship. Until then, the seller bears the transportation cost to the destination port. Insurance for items is not included in the price. When the seller gives the items to the carrier, he has fulfilled his delivery responsibility (not when the products reach their destination). This Incoterm was previously known as CNF or C&F.

CIF (Cost, Insurance, and Freight)

While similar to CFR, CIF differs as the seller must also arrange for and pay for the products’ transportation insurance to the destination port.

You must often review your Incoterms. Doing so means that you can guarantee that your agreements are up-to-date. It is helpful to study new trade agreements so that you are prepared for anything. In this manner, you may ensure that the agreements are accurate and that you use the most recent update. Avoid simply copying your terms and arrangements from contract to contract.

Before negotiating the sale agreement terms, importers and exporters should decide which Incoterms will work best. Through clear communication, unexpected expenses and needless difficulties may be avoided.

Selecting an Incoterm ensures that you and your supplier agree on shipping protocols when several companies and stakeholders are involved. These widely recognized words safeguard suppliers, transporters, and purchasers while guaranteeing the prompt payment of products, services, and tariffs.

Aratum gives your business the transparency and visibility to navigate and set Incoterms 2024 with your partners easily. Our digital supply chain solutions cover the management of orders, financials, inventory, and transportation. Book a demo and discover how our online management systems make Incoterms 2024 simple to understand.

The featured photo of this article was sourced from freepik.