A company’s fiscal well-being and future profitability hinge on grasping the quantity and value of available products or materials. Inventory is important and subject to measurement at various stages of the accounting cycle. Beginning inventory represents the initial count essential for your business at the onset of an accounting period.

Beginning or opening inventory represents the total value of a company’s available stock, ready for sale at the start of a new accounting period. The value of ending inventory from the previous accounting period should match this figure. Tracking beginning inventory is crucial for businesses to regulate stock levels, oversee inventory, and make informed purchasing decisions.

The composition of beginning inventory differs between manufacturers and retailers. It may include raw materials, work-in-progress, and finished goods for manufacturers. In contrast, retailers typically start with items ready for immediate purchase by customers.

The Importance of Beginning Inventory

Businesses that meticulously track their beginning inventory levels reap numerous benefits. The primary advantage lies in their ability to gauge fluctuations in inventory levels over time, using the initial inventory count as a reference point. This data serves to assess production efficiency and anticipate future inventory needs.

However, when evaluating a business’s status and environment, it’s essential to acknowledge that inventory level changes are just one facet. Relying solely on inventory levels to gauge environmental shifts is inadequate. A comprehensive understanding of evolving business landscapes necessitates considering additional factors, such as shifts in client demand or the introduction of new products.

Moreover, beginning inventory plays a pivotal role in accounting. It is a cornerstone for balance sheets and other internal accounting records, providing insights into the beginning inventory value. Leveraging this data enables eCommerce businesses to monitor their financial health and make informed investment decisions. Additionally, beginning inventory holds significance in tax calculations.

Furthermore, it forms the basis for determining the cost of goods sold (COGS), a critical metric for online merchants. COGS offers valuable insights into operational profitability, indicating the cost incurred in generating goods or services. Calculated by subtracting the ending inventory value from the sum of beginning inventory and purchase costs during the period, accurate COGS data relies on precise beginning inventory records. This, in turn, informs decisions regarding gross profit.

Knowing your initial inventory has many advantages. Consider the following:

Transparency

Your beginning inventory provides information on how much stock you must manage and how much you should order to prevent stockouts. It can also be used to calculate the number of products sold over a specific period.

Better Forecasting

Knowing your inventory levels at the start of an accounting period is best. It’ll allow you to make more informed purchases based on anticipated demand for the remainder of that period. This is especially useful to prepare for seasonal demand before the holidays’ peak season.

Improved Inventory Management

Track the inventory at risk of becoming unsellable to detect better merchandise at risk of becoming “dead stock.” Additionally, you’ll be more aware of the status of your goods so you can prevent stockouts.

COGS Valuation

You need to be aware of your beginning inventory to determine COGS. Your COGS is the sum of your product sales over a given period, less your initial inventory. Knowing these two metrics can help you determine how much it will cost to manufacture and market your goods.

Calculating for Beginning Inventory

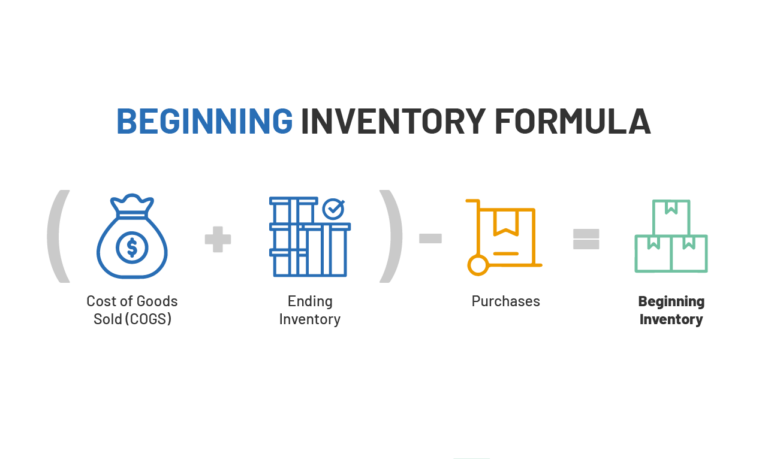

The formula for beginning inventory is as follows:

Beginning inventory = (COGS + ending inventory) – cost of inventory purchases

Before using the formula, we must understand each variable to compute the inventory initially.

Cost of Goods Sold

The cost of goods sold (COGS) reflects the amount spent on producing already sold things. It comprises the cost of labor, shipping, manufacturing, and raw materials.

The formula for determining the cost of goods sold is as follows:

COGS = (beginning inventory + purchases) – ending inventory

In other words, the amount you initially spent for the items you sold to clients during that time is the cost of goods sold.

COGS = Manufacturing Price x Quantity

Depending on your inventory system, the cost of items sold may vary. There are four standard popular inventory systems. Whichever your choice is, you must commit to it. You risk having inconsistent data in your reporting if you do not maintain continuity with the inventory system.

- Weighted Average Cost (WAC)

This valuation method, or the average cost method, works best for companies that ship items of comparable sizes. Its formula is as follows:

WAC = Cost of goods available for sale / Total units in inventory

- Specific Identification Method

Each item is tracked separately, leading to consistently precise data. This approach works well for companies whose goods come in various sizes and prices. This method has no set formula; you only have to tag every item with its purchase price and any subsequent costs until it is sold.

- First-in First-out (FIFO)

FIFO is a popular valuation technique because of its simplicity. As the name suggests, inventory that is produced first will be sold first. By using this technique, you may determine the overall value depending on the stock that you currently have.

- Last-in First-out (LIFO)

LIFO is a less popular inventory valuation technique since most merchants don’t sell their newest products first. There are, however, tax benefits to doing so. Higher COGS and a smaller balance of leftover inventory due to LIFO lead to lower taxes and increased cash flow.

Ending Inventory

You can determine your ending inventory using the accounting records from the previous financial period. In other words, your beginning Q2 inventory should be the same as your closing Q3 inventory.

If you’re calculating ending inventory for the first time, you’ll need to figure out how much new stock was bought and sold over a certain period.

Ending Inventory = Beginning Inventory + Net Purchases – COGS

Alternatively, you can get this value by multiplying the number of items and materials left in stock by their value.

Ending Inventory = Manufacturing Price x Remaining Quantity

With all these variables, you can now begin calculating your beginning inventory. First, you must determine your COGS by referencing the records from your previous accounting periods.

To better illustrate these computations, let’s use an example. Suppose you run an online business selling basketball shoes. You sold 200 pairs of a particular sneaker that cost $140. Our COGS will be $28,000.

$28,000 = 200 shoes x $140

By the end of the accounting period, 40 pairs of shoes will be left for an ending inventory of $5,600.

$5,600 = 40 shoes x $140

To accommodate demand, you purchase 120 new pairs of shoes at the start of a new accounting period. This gives us a total purchase value of $16,800.

$16,800 = 120 shoes, $140

With all the necessary data complete, we can now begin to compute for our beginning inventory:

Beginning Inventory = ($28,000 +$5,600) – $16,800

This gives us a beginning inventory of $16,800 at the start of a new accounting period.

According to the initial inventory calculation, this is the amount of stock your eCommerce company should invest within the current accounting period. You may utilize this information to complete your balance sheets, match it up with internal accounting records, and prepare for tax documentation.

A company can forecast future product demand using historical inventory, seasonality, and sales data. Demand forecasting is a technique for estimating future sales.

Your business can answer how much inventory is required for stock, fulfilling future orders, and how frequently to restock. You can also better understand how sales trends change with demand forecasting. It can also be used to calculate projected sales and revenue totals. Demand forecasting assists an organization at a larger scale with budget planning, production scheduling, determining storage requirements, and product pricing strategies.

Mastering the calculation of your beginning inventory is just the beginning of enhancing your business’s financial stability and inventory management. With Aratum, you gain access to vital data for determining optimal inventory levels. Seamlessly synchronize with various online platforms and receive immediate insights into stock dynamics. Schedule a demo today to explore the possibilities.

The cover photo of this article was sourced from freepik.